Originally published in Smart Business Dealmakers

Often, growing your company is not just about making money. It’s a part of your identity.

“The idea of selling to a third party and being told it’s time to play golf for the rest of your life is terrifying to many,” Bruce Lazear says. “They don’t want to be irrelevant — and being rich doesn’t make them relevant. They have friends at the country club bored to tears.”

The partner at Lazear Capital Partners can identify with that.

“As someone who has had a business for 20 years, I appreciate how much it means to me at a level that’s beyond its earnings,” he says. “It’s part of my life. I enjoy the creative process of going to work. So do our clients.”

That’s where an employee stock ownership plan comes in.

“With an ESOP, they can remain the CEO, even as they get their liquidity and their payments, and still be part of leading their team, growing their people and servicing their customers,” Lazear says.

However, few people truly understand the fundamentals.

“If you really explain how ESOPs work to entrepreneurs, about half the time they would choose this over signing the company to a third party,” he says.

Lazear, who’s firm handled 16 ESOP transactions in 2019, breaks it down for business owners.

An ESOP primer

An ESOP is an ownership transition tool that enables the owner to sell the business to a retirement plan, Lazear says. That retirement plan’s primary investment is the business stock, and employees participate in the plan with shares usually based on their relative payroll.

In his experience, virtually 100 percent of CEOs/owners remain with the company after the sale.

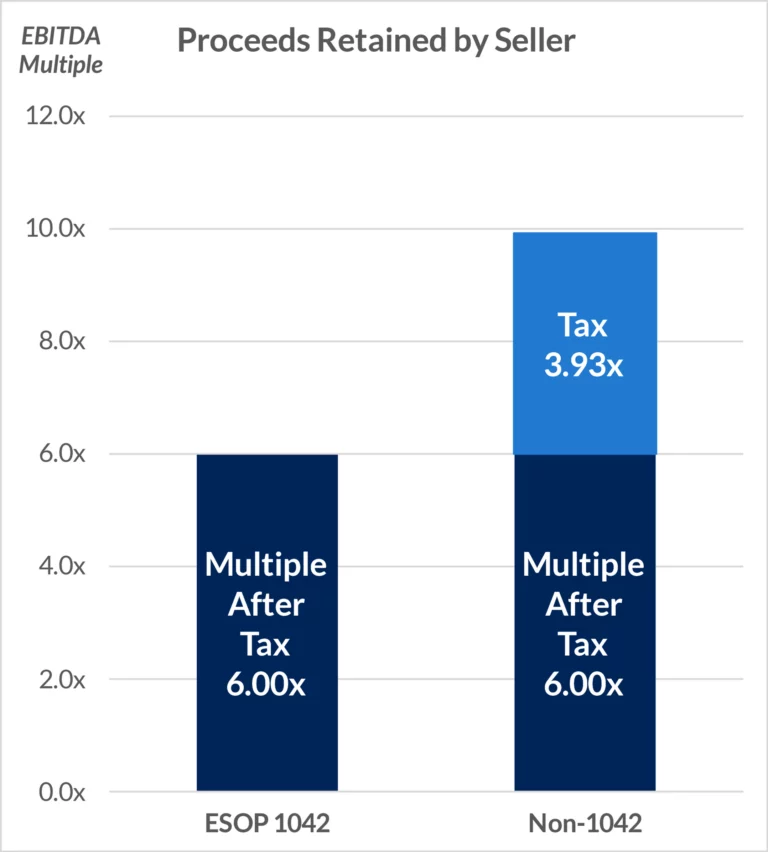

ESOPs also enable people to sell and not have to pay income tax on the gain of the sale, he says. In addition, future earnings of the company are tax free.

These plans can work across a broad array of businesses but are typically used by:

Consultancies, meaning the company sells time and advice.

Companies in which the material portion of the purchase price is contingent, usually based on future earnings.

C corporations that sell assets.

A business where there’s not a natural buyer.

Companies where the intellectual capital and employees are a true asset.

“Manufacturers, distribution, trucking, construction companies, consultancies like systems integrators, computer consulting firms, staffing firms — those are all ideal ESOP targets because it’s a great answer for the owners and the employees,” Lazear says.

On the other hand, technology or high-growth companies that can be sold for a price that based on future earnings are not good candidates. They are worth more when they go through a sales process.

In an ESOP, the value is set at fair market value, which the IRS defines as the price a willing buyer and a willing seller would agree on at arm’s length, with neither having the compulsion to buy or sell.

Lazear believes the reason ESOPs are becoming quite popular again is partly due to a growing awareness in the professional community. When Lazear Capital does an ESOP with an owner, their lawyer, accountant, banker, etc., often like the results and want to learn more.

“It’s like dominoes in every direction,” he says.

In addition, an enormous transfer of wealth is occurring in the U.S. as baby boomers grow older.

“The economy has been good and expanding for about 10 years,” Lazear says. “So many of these companies that might have been in trouble in the Great Recession have recovered. They’re highly valuable and their owners are of an age where they’re looking for liquidity events for the benefit of themselves, their families and their charities.”

Setting out the structure

Lazear sees a lot of success that comes from an ESOP transition, but he admits that any time you sell your business, there’s no guarantee of the future.

“If you sell it to private equity or a competitor, there’s no guarantee of success years down the road,” he says. “Nor is there if it’s an ESOP. There’s not a guarantee of success. There’s no guarantees in this world, except for death and taxes. But it’s a heck of a way to create a transition, retain a life of relevance and help your team get great tax advantages, which really means more net money for your family.”

Structure, however, is important. ESOPs need to bring together all affiliates into one holding company and should include a board mechanism that lets the CEO run the company just like he or she did before. The plan also needs to set up a cash reserve that helps with the repurchase obligation, which is the obligation to repurchase shares of departed employees.

Sometimes it also makes sense to exit an ESOP if many retirements are coming up or an acquirer approaches the company with a price offer significantly higher than the share value.

Transactions can vary from straightforward — one entity that’s 100 percent owned by one person — to complex.

“The complexity of the transaction is premised largely upon how many entities, how sophisticated the clients are, how good their financial information is and how many goals they have that we’re trying to attain that require structures that are more sophisticated to get them to the outcomes that they want to achieve,” Lazear says.

In addition, in the early years, cash must be paid to the seller to pay off the purchase price, which can slow growth — unless the seller is willing to take payments more slowly, he says. But that can happen with any seller, including a PE firm that leverages it up heavily.

Take action: If you are considering selling your company in 2022 and haven’t explored the option to sell to an ESOP, you may want to consider whether a non-ESOP buyer can match the higher valuation multiple needed to equal the after-tax proceeds on a tax-deferred sale.